Solar Project Financial Modeling - A Case Study

I found this case from the G.O.A.T. of Project Finance, Mr. Edward Bodmer, I then built a financial model for this particular Solar Energy Project.

Steps of Financial Modeling for Project Finance

- Get timelines worked out

- Start with operation, never start with Profit & Loss, Balance Sheet, Cash Flow

- Put together Capital Expenditure, Revenue and Expenses, Project Internal Rate of Return (IRR) and its pre-tax level

- Put depreciation without Interest During Construction (IDC) and then after-tax Project IRR

- Financing - different sources, uses and debt repayment and debt balance

- Cash Flow waterfall. Define Cash Flow Available for Debt Service (CFADS) and Equity Cash Flow to get Equity IRR

- Resolve Circular Reference for interest during construction (IDC)

- Finish all other financial statements

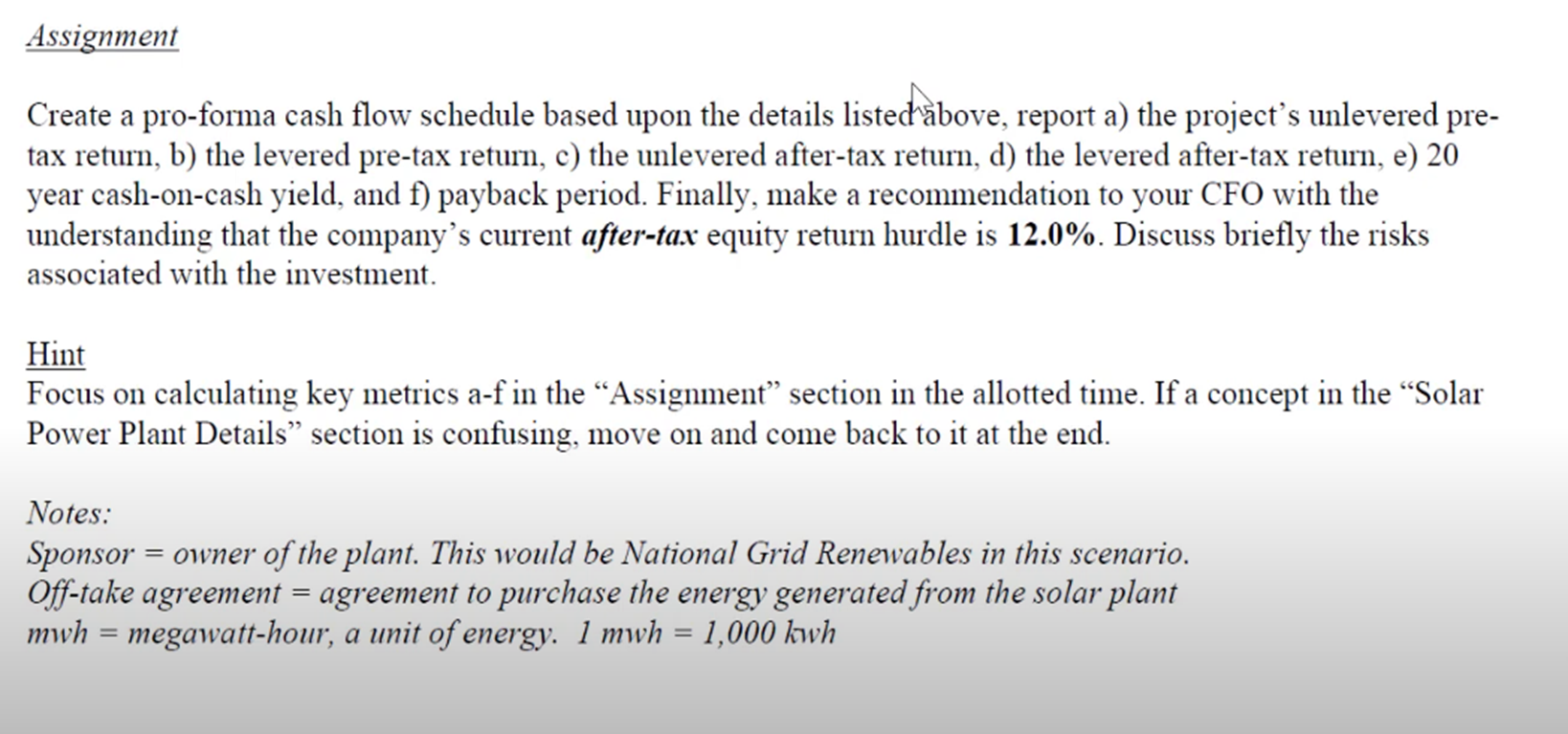

The case

Thoughts on this case

I usually find it helpful to have an idea what to expect before starting modeling. For solar project, we will expect Capex to be around USD 1.5 million per MW. Hence, the Capex in this case is clearly on a very high side and that should take a toll on our Project IRR. Therefore, I didn’t flip out when I saw a negative project IRR. This was further confirmed as I built in other scenarios with lower capex and that improved the Project IRR significantly.